GM from THE RWA DESK! Your one-stop shop for everything RWA. Front-Row Intelligence, Front-line Dealflow.

The RWA Desk resumes with Edition 5, shipping real-time insight on institutional RWA adoption.

Floor of the NYSE

Here’s What We Got For You:

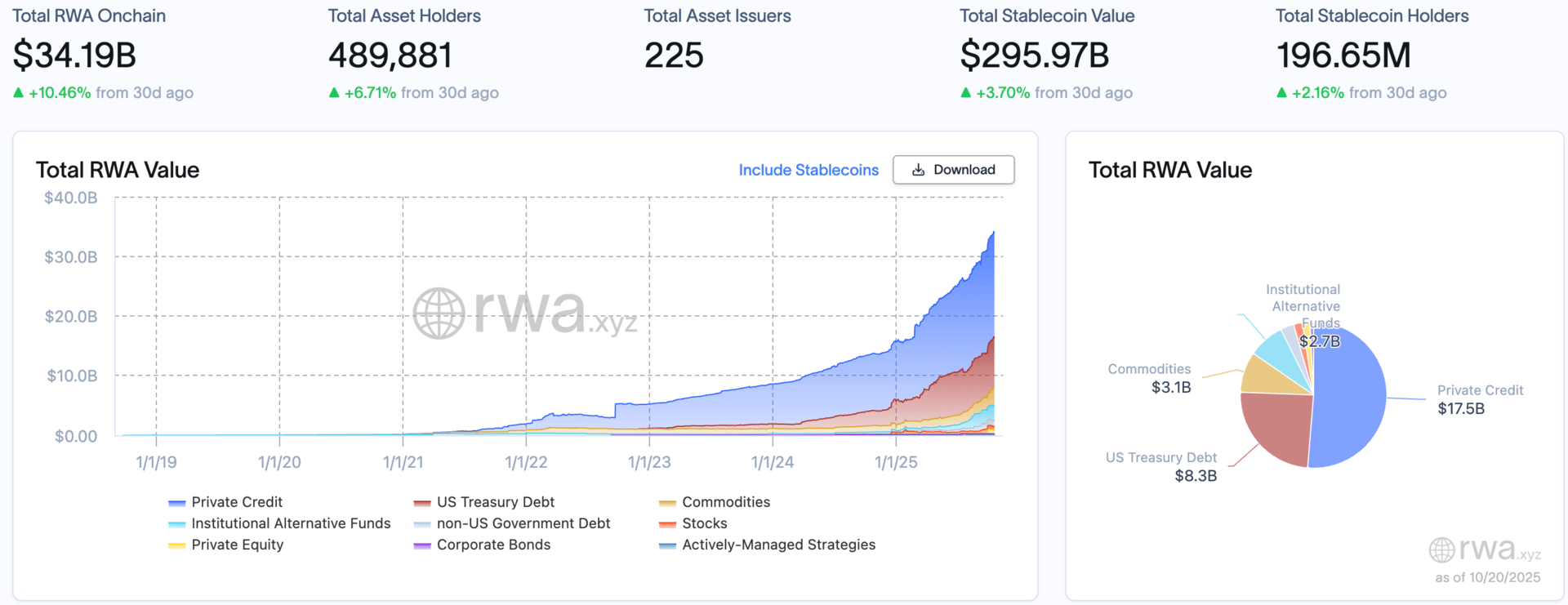

RWA Market Snapshot — $34B in RWA TVL & 490k Holders

Insider Opinion — MEDICI

Top Stories We’re Watching — BlackRock & SS&C/Carlyle

Front-Line Deal Sheet — $2.2B in Selected Deal Flow

Desk Chatter — Liquidations

1.RWA Market Snapshot

RWAs Are Now $34B & 490k Holders!

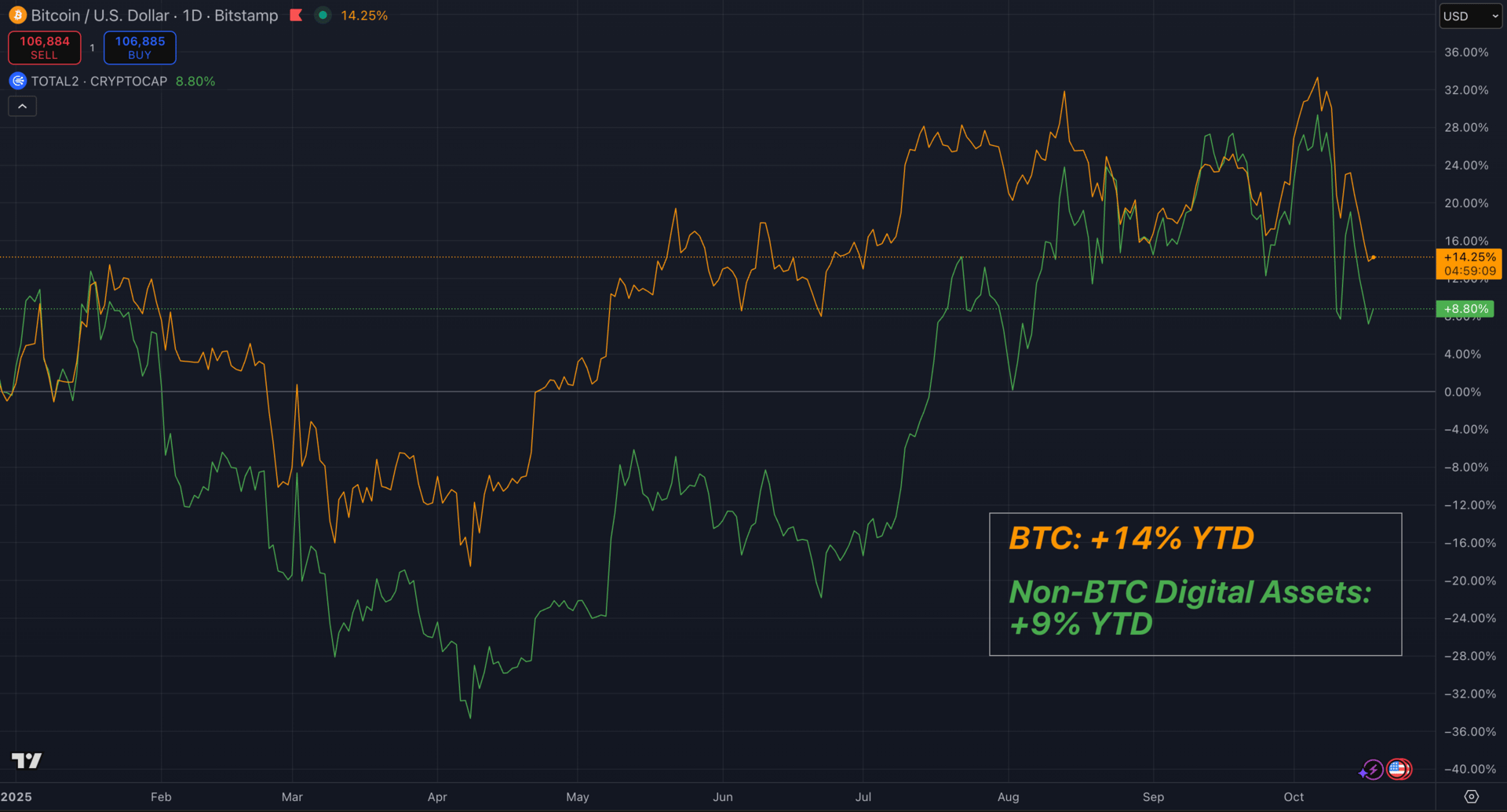

Quick Reframing: Year-To-Date Crypto Returns

BTC & Non-BTC Digital Assets YTD Performance

2. Insider Opinions

Eliot Puplett, CEO & Co-Founder, MEDICI

Why Private Market Incumbents Resist Tokenization: An Incentive Problem

RWA adoption in private markets isn't held back by technology risk—it's held back by misaligned incentives. Fund managers in illiquid markets benefit from limited price discovery. Opacity keeps valuations elevated and competitors at bay. Tokenization threatens this: on-chain transparency invites scrutiny, and programmable liquidity erodes information asymmetry.

Meanwhile, institutional LPs—the capital gatekeepers—lack the internal expertise to evaluate blockchain infrastructure. Without LP pressure, managers face adoption costs with zero fundraising upside. Rational actors don't sign up for that.

Change will come from the edges: younger funds chasing offshore capital or velocity-dependent strategies where liquidity access justifies the infrastructure investment. Once these funds demonstrate durable competitive advantage, incumbents won't choose to follow—they'll be forced to adapt or lose capital.

Tokenization scales when staying put becomes more expensive than moving forward.

RWA Desk Partner: Morning Brew

Your career will thank you.

Over 4 million professionals start their day with Morning Brew—because business news doesn’t have to be boring.

Each daily email breaks down the biggest stories in business, tech, and finance with clarity, wit, and relevance—so you're not just informed, you're actually interested.

Whether you’re leading meetings or just trying to keep up, Morning Brew helps you talk the talk without digging through social media or jargon-packed articles. And odds are, it’s already sitting in your coworker’s inbox—so you’ll have plenty to chat about.

It’s 100% free and takes less than 15 seconds to sign up, so try it today and see how Morning Brew is transforming business media for the better.

3. Top Stories We’re Watching

BlackRock Building Its Own Tokenization Platform

On their Q3 call, BlackRock said it’s developing proprietary tokenization technology—moving from a single-product footprint (BUIDL via Securitize) to a broader platform that could bring funds and even ETFs on-chain. Larry Fink framed tokenization as the next bridge between traditional markets and digital wallets. Multiple outlets report teams across BlackRock are now executing on that mandate. For RWAs, this signals a shift from “partner-only” distribution to first-party rails owned by the world’s largest asset manager—meaning scale, compliance, and product breadth could accelerate quickly from here.

SS&C Acquires Calastone From Carlyle

SS&C Technologies has completed its $1.03B acquisition of Calastone from Carlyle, bringing the world’s largest global funds network inside a top-3 fund administrator. Calastone connects 4,500+ institutions across ~57 markets and processes £250B+ monthly, positioning SS&C to automate fund subscriptions/redemptions, transfer agency, and tokenized-fund operations at scale. The deal was funded with cash and debt and follows the July announcement to acquire. SS&C expects it to be accretive within 12 months. For RWAs, this is mainstream distribution meeting blockchain-native settlement—exactly the kind of infrastructure tie-up that moves tokenization from pilots to production.

4. Noteworthy Transactions (Oct 2025)

Deal | Date | Desc. | Size | Parties |

|---|---|---|---|---|

PayPay Acquires Binance Japan | 10/9 | PayPay Acquired 40% Stake In Binance Japan | Undisclosed | SoftBank, Binance, Paypay |

Block Street Capital Raise | 10/9 | Tokenized Stock Platform Launches | $11.5M | Hack VC, DWF Labs, Generative Ventures |

Prestige Wealth Backs Tether | 10/13 | Tether x Gold-Backed Treasury | $150M | Antalpha, Tether, Kiara Capital, |

SS&C Acquires Calastone | 10/14 | Fund Admin Embraces Tokenization | $1.03B | Carlyle & SS&C |

Kraken Acquires “Small Exchange” | 10/16 | Kraken Positions For U.S Derivatives | $100M | Kraken & IG Group |

Ripple Acquires GTreasury | 10/17 | Ripple Bridges Into Corp. Treasuries | $1B | Ripple & GTreasury |

5. The RWA Desk Chatter

Liquidations, margin calls, and stop losses. October 10, 2025 was the singular worst-performing day in crypto history. Crypto lost $820+ Billion in market cap due to Trump announcing a 100% tariff on Chinese goods. Prices didn’t just fall; the market’s plumbing seized—thin order books, oracle lag, cascading liquidations, and risk engines tripping over each other. It was a stress test that revealed the same thing every crash reveals: leverage is a privilege, collateral quality is everything, and liquidity disappears right when you need it most.

The lesson isn’t “never use leverage.” It’s to design for bad days. Keep dry powder in instruments that settle fast (tokenized T-bills), diversify venues and counterparties, know your risk parameters after slippage, and pre-commit your de-risking ladder before you’re emotional. Hold assets with uncorrelated exposure—cash-flowing, low-beta yield, hard assets for debasement risk, growth bets where you can withstand a 50%+ drawdown without getting stopped out. Flash crashes don’t break robust portfolios, they expose fragile ones.

If you’re building, same rule: ship products that behave under stress—clear margin rules, transparent collateral, real circuit breakers, honest disclosures. If you’re allocating, measure strategies by correlation and risk, not just absolute returns.

When the screen is red and the timeline is loud, remember that time preference is the only edge that compounds in this space.

ZOOM OUT.

If you’re looking for support on your RWA initiatives, we are confident we can route you in the right direction. Reach out here.

Catch ya on the next—

THE RWA DESK