GM from THE RWA DESK! Your one-stop shop for everything RWA. Front-Row Intelligence, Front-line Dealflow.

The RWA Desk picks up with Edition 6, shipping real-time insight on institutional RWA adoption.

Assets on Blockchain conference, Harvard Club of NYC

Here’s What We Got For You:

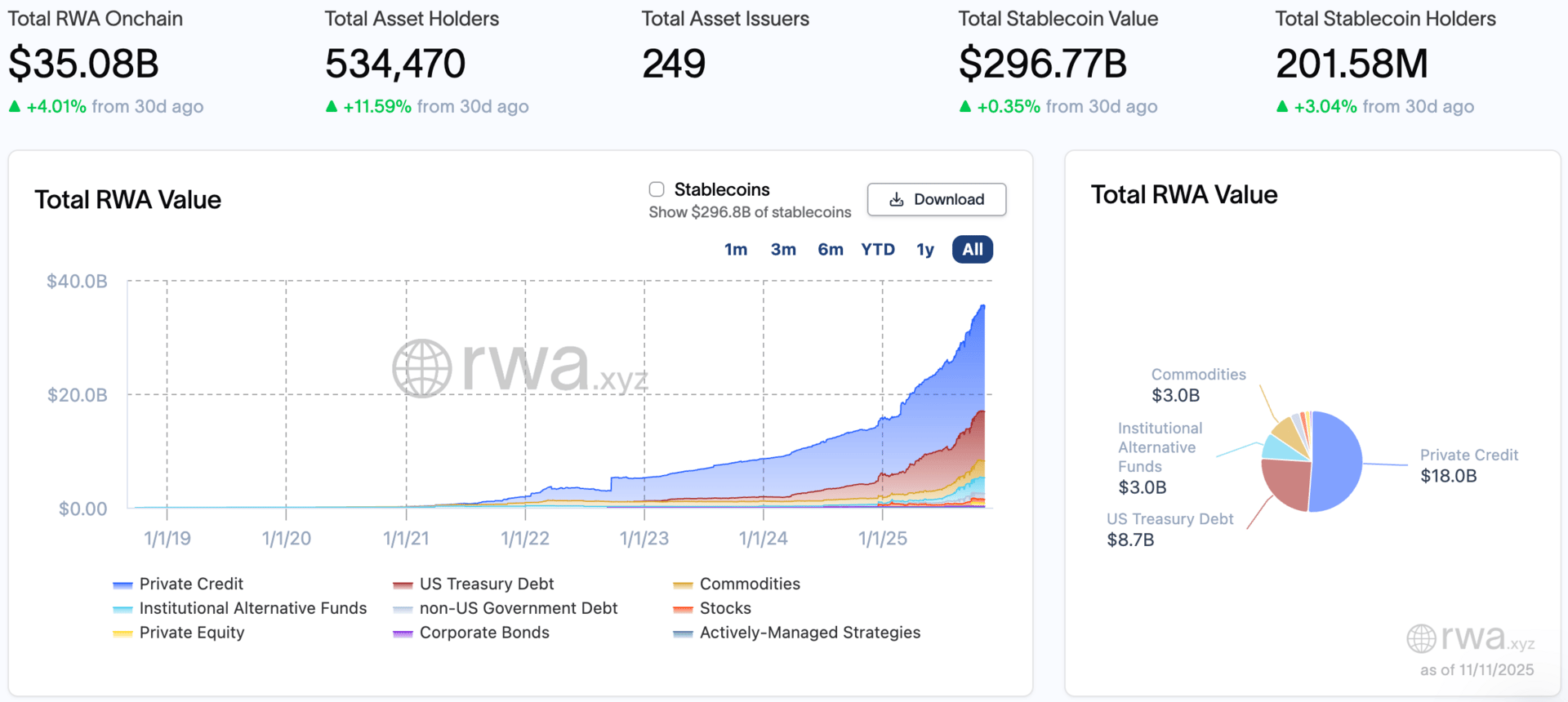

RWA Market Snapshot — $35B in RWA TVL & 535k Holders

Insider Opinion — Renee Berman, Ex-MD, DTCC

Top Stories We’re Watching — Securitize & Secondaries

Front-Line Deal Sheet — $1.35B in Selected Deal Flow

Desk Chatter — Equity vs Tokens

1.RWA Market Snapshot

RWAs Sit At $35B & 535k Holders!

2. Insider Opinions

Renée Berman, Ex-Managing Director of Digital Assets, DTCC

Today, most real-world asset (RWA) tokenization efforts have centered on expanding distribution into DeFi to attract new investors and increase AUM. However, with institutional adoption of digital assets accelerating, tokenization is entering a new phase focused on unlocking operational efficiency, improving liquidity, and reshaping market structure.

Key drivers of this shift include:

•Growth of stablecoins & regulatory clarity: The GENIUS Act is expected to boost stablecoin issuance for frictionless, real-time, cross-border payments.

•On-chain treasury management: As treasurers grow comfortable holding stablecoins, tokenized money market funds will increasingly be used to earn yield on idle cash—stablecoins as checking accounts, tokenized MMFs as savings

•Operational efficiency: Smart contracts streamline settlement, reconciliation, and asset servicing, lowering costs and risk. BlackRock’s plans to tokenize ETFs to capture these efficiencies will serve as a catalyst for other firms to follow suite.

•Real-time collateral mobility: As demonstrated by DTCC’s Great Collateral Experiment, tokenized collateral can move instantly across platforms and jurisdictions, reducing capital requirements and drawing more traditional institutions on-chain.

RWA tokenization is evolving from a distribution strategy into a fundamental upgrade to financial infrastructure. Stablecoins, tokenized cash products, smart contract automation, and instant collateral movement are laying the foundation for a more efficient, transparent, and globally interoperable financial system.

RWA Desk Partners

3. Top Stories We’re Watching

Securitize Going Public via Cantor SPAC at $1.25B

Tokenization platform Securitize will go public by merging with Cantor Equity Partners II, a SPAC sponsored by an affiliate of Cantor Fitzgerald, in a deal valuing the company at $1.25B and targeting a Nasdaq listing (ticker SECZ). The company says it will tokenize its own equity as part of the process—an industry first—with expected gross proceeds of roughly $465M if redemptions are limited. Timeline guidance points to 1H 2026, with Citi and Cantor as advisors; existing backers include BlackRock and ARK. Net: one of the category leaders in RWAs is choosing the public route while showcasing its own rails.

Private Markets Hit Mainstream (Schwab × Forge. Morgan Stanley × EquityZen. Goldman Sachs x Industry Ventures.)

Two blue-chip moves in a week push secondary private shares into prime time. Charles Schwab will acquire Forge Global for $660M (cash, $45/share), aiming to plug a private-shares marketplace into a platform with $11.6T in client assets—i.e., distribution at scale for pre-IPO names like SpaceX and OpenAI. Closing is targeted for H1 26’. Meanwhile, Morgan Stanley agreed to buy EquityZen, a 13-year-old secondary platform with 800k users and 49k+ transactions, to deepen private-market access for its wealth clients; terms undisclosed, closing expected early 2026.

4. Noteworthy Transactions (Nov 2025)

Deal | Date | Desc. | Size | Parties |

|---|---|---|---|---|

Securitize SPAC | 10/28 | Securitize SPAC at $1.25B Valuation | $225M | Cantor Fitzgerald, Citi, Boarderless Cap, BlackRock |

Hercle Capital Raise | 10/29 | Institutional Infra for FX & Cross-Boarder Payments | $60M | F-Prime, Vulgar Ventures |

Accountable Capital Raise | 10/29 | Vault-as-a-Service & Data Verification Startup | $7.5M | Onigiri Capital, Pantera, OKX, KPK |

Tharimmune Launches Canton Treasury Strategy | 11/3 | Digital Asset Treasury With New Canton Coin | $540M | Liberty City Ventures, Kraken, Polychain Capital |

Ripple Capital Raise | 11/5 | Strategic Investment for Greater Distribution | $500M | Citadel, Pantera, Brevan Howard |

Faktion Acquires Pecule | 11/6 | European Tokenization Platform Gains Traction | Undisclosed | Faktion, Pecule |

CommonwareCapital Raise | 11/7 | Payments/RWABased Infra | $25M | Tempo, Stripe, Paradigm |

5. The RWA Desk Chatter

Start from first principles: capital is a contract. The form you choose determines the claims, the accountability, and the buyers you can access. If your product is mission-critical market infrastructure (issuance, custody, transfer agency) your customers are banks, asset managers, and corporates with auditors, regulators, and procurement checklists. Those buyers don’t want vibes, they want audited financials, enforceable rights, board accountability, and underwritten liquidity. Public equity provides all four in a package the system already understands.

Equity is trust made legible. A listed company files 10-Ks, submits to PCAOB audits, carries director duties, and can raise follow-on capital with regulated disclosures. That lowers your cost of capital, shortens enterprise sales cycles (“vendor diligence” > “token explainers”), and gives you real M&A currency to roll up registries, fund admins, servicers, and data rails. Equity also creates a single, clean residual claim that risk committees can model. When your promise is “we’ll safeguard other people’s money,” you pick the instrument courts and compliance teams already rely on.

Tokens are coordination tools, not credibility substitutes. They excel when the hard problem is distribution, usage incentives, or permissionless participation, bootstrapping liquidity, rewarding routing, embedding fee logic. They struggle where the hard problem is fiduciary assurance, stable rights, predictable cash flows, and liability that survives a cycle. Volatility, ambiguous claims, and evolving policy all translate into procurement friction for institutional buyers. Tokens can still sit at the product edge (access tiers, fee rebates, collateral mechanics), but they are the wrong primitive for your corporate core when your buyer is a risk committee.

RWA infrastructure is graduating from project to vendor. The control plane of tokenized finance (recordkeeping, compliance, and settlement) wins by being boring, dependable, and litigable. Public equity is the right tool for that job. Expect hybrid architectures: public-company balance sheets at the core; tokenized features where programmability actually improves cost, reach, or collateral utility. The winners won’t argue “equity vs. token.” They’ll map the instrument to the function, earn trust with stock at the core, and earn usage with tokens at the edge.

Catch ya on the next—

THE RWA DESK