GM from THE RWA DESK! Your one-stop shop for everything RWA Front-Row Intelligence, Front-line Dealflow.

The RWA Desk enters Edition 3 with the same mission: delivering sharp intelligence and insight across the real-world asset landscape.

Earlier this month, we hosted our sixth NYC RWA Meetup with panelists from Chainlink, Hypernative, and Hedera on Building Institutional Trust in RWAs—how secure data, real-time risk monitoring, and enterprise-grade networks drive adoption from pilots to production.

We host these rooms to surface the insights, best practices, and conversations that matter most to builders—key takeaways from our event are in the Desk Chatter below.

Alex Rabke, Hypernative, Kostiantyn Dmitriiev, Chainlink, John Kikko, Hedera & Chad Oda, NYC RWA Meetp at NYC RWA Meetup VI at Unveiled

RWA Folks Enjoying Themselves

Here’s What We Got For You:

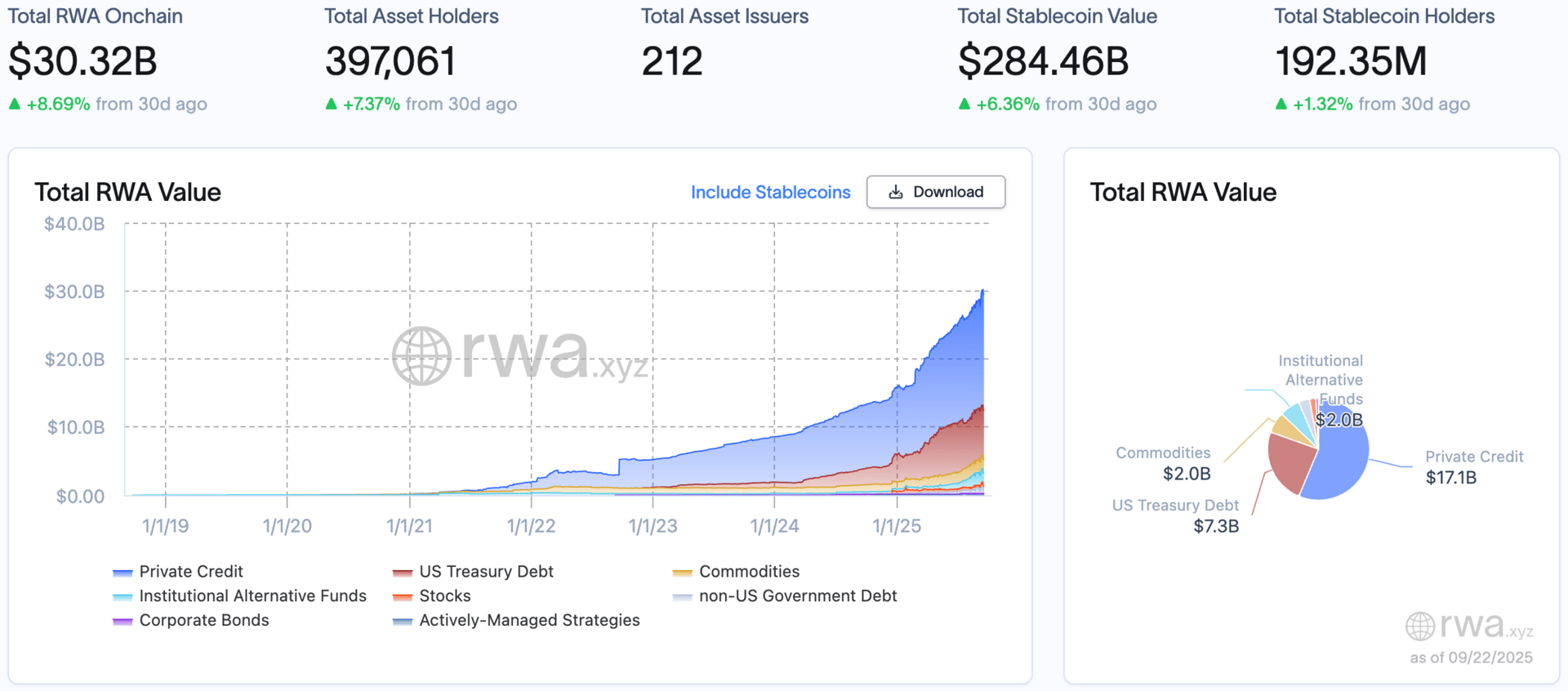

RWA Market Snapshot — $30B in RWA TVL & Nearly 400k Holders

Insider Opinion — Transparent Capital

Top Stories We’re Watching — Figure, Centrifuge & Fnality

Front-Line Deal Sheet — $800M in Selected Deal Flow

Desk Chatter — NYC’s Pulse on RWA’s

1.RWA Market Snapshot

RWAs Just Crossed $30B Onchain & Nearly 400k Holders!

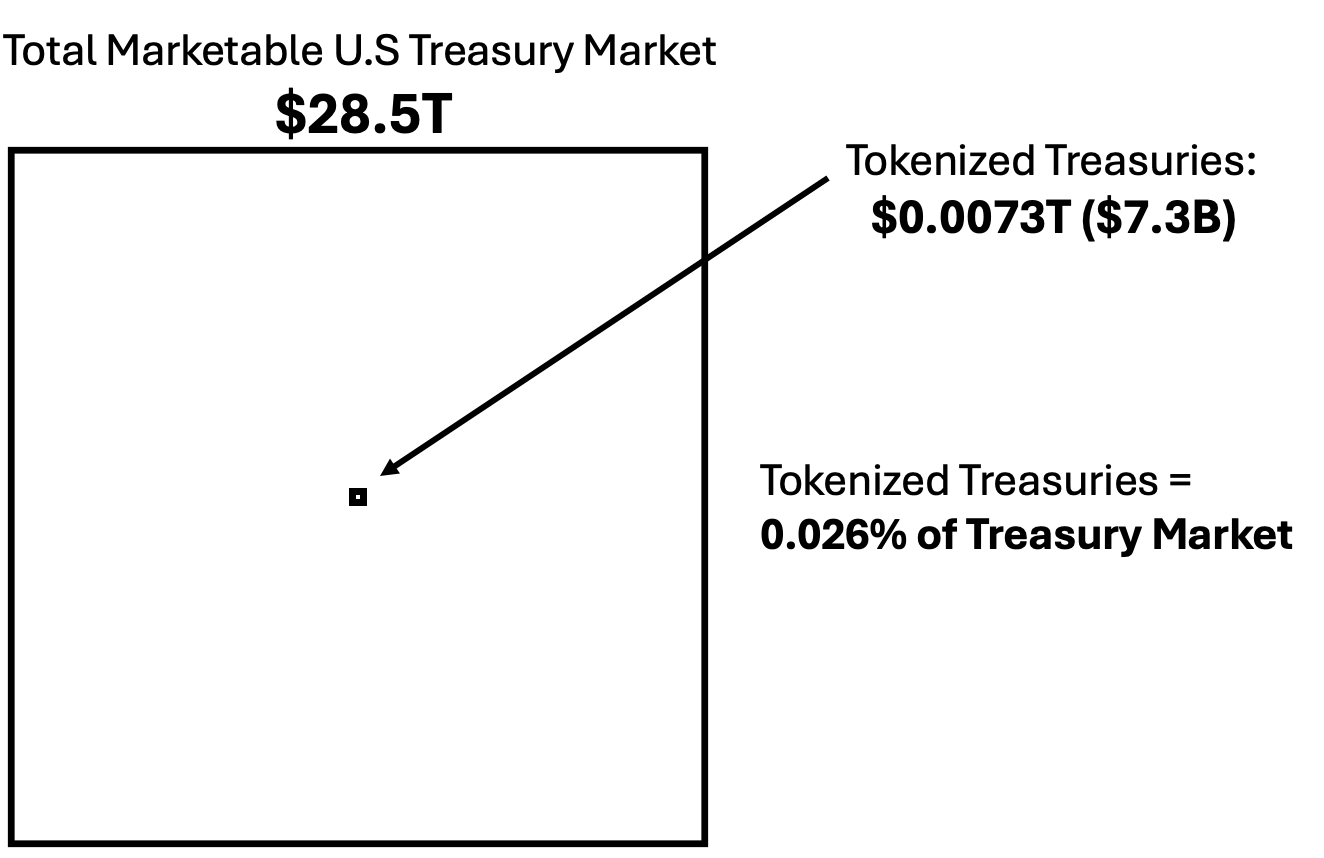

Quick Reframing: We Are Still Early…

2. Insider Opinions

Jack Bronson, Partner, Transparent Capital

Listen, I come from RMBS Cap Markets. I liken the state of the industry to being pitched by Lew Ranieri to be one of the first buyers of Mortgage Backed Securities. Some people would think, “this guy is bat s**t crazy.” But fast forward to the market today and there is a highly mature industry providing greater opportunities for home buyers, investment grade products for institutions and liquid markets in which they can transact these products.

The questions remain: “How do we get there? And how do we not make the same mistakes?” Early buyers of tokenized credit are already operating in fragmented, uncompetitive markets. That’s the spark: as early investors capture outsized spreads, risk perception declines, more participants enter, and liquidity builds. At Transparent we believe it’s on today’s participants to enact standards in diligence and underwriting to avoid becoming susceptible to past market mistakes. The result: liquid and efficient onchain credit markets.

RWA Desk Sponsors

Hypernative safeguards onchain Institutions, RWAs and DeFi protocols with real-time monitoring, security, compliance and proactive risk solutions

3. Top Stories We’re Watching

Figure IPO’s on Nasdaq $FIGR ( ▼ 11.57% )

Figure Technology, a blockchain-based home-equity lender, priced its Nasdaq IPO at $25, selling 31.5M shares to raise $787.5M and implying a ~$5.3B initial valuation. The company runs origination and servicing on the Provenance blockchain to compress funding timelines to ~10 days vs. ~42 day industry average—and its S-1 shows a business with $190–191M revenue and $29M net income in 1H’25. Shares popped on debut, underscoring investor appetite for “tokenized credit” done at production scale.

Centrifuge Launches deRWA on Stellar

Centrifuge is bringing its deRWA format to the Stellar network with an initial $20M anchor allocation across two tokens: deJTRSY (a DeFi version of Janus Henderson’s short-term U.S. Treasury strategy) and deJAAA (a DeFi AAA-rated CLO strategy). The aim is simple: put yield-bearing RWAs directly into Stellar-based apps with programmable transfers and faster servicing—moving beyond pilots toward distribution at scale.

Fnality Raises $136M Series C

Fnality, the wholesale DLT payment system behind the U.K.’s sterling Fnality Payment System, raised $135–136M (Series C) led by Bank of America, Citi, WisdomTree, KBC, Temasek, and Tradeweb, with major incumbents returning (Barclays, BNP Paribas, DTCC, Euroclear, Goldman Sachs, ING, State Street, UBS). Proceeds expand its central-bank-regulated rails beyond sterling and deepen use cases like intraday repo and tokenized-asset settlement—i.e., buying speed, liquidity savings, and 24/7 finality inside the perimeter.

4. Noteworthy Transactions (Sep 2025)

Deal | Date | Desc. | Size | Parties |

|---|---|---|---|---|

Centrifuge’s deRWA | 9/17 | 2 New Tokenized Funds Go Live on Stellar | $20M | Janus Henderson, Stellar, Centrifuge |

Apollo Diversified Credit Fund | 9/22 | Tokenized Apollo Credit Fund Goes Live | $50M | Apollo; Plume; Centrifuge; Grove; Anemoy; Sky Ecosystem |

9/22 | Avalanche Digital Asset Treasury | $550M | Ava Labs, SkyBridge, Coinbase & more | |

9/22 | Seed | $11M | Various Angel Investors | |

9/22 | VC fund launch | $35M | ||

9/24 | Series C | $135M | WisdomTree, BoA, Tradeweb, Citi, Goldman Sachs & more |

5. The RWA Desk Chatter

We are incredibly grateful to have hosted 150+ attendees at our meetup in Brooklyn last week. Institutional folks—and crypto natives—kicked back, exchanged notes, and made connections. Here are some quick notes from our event:

NYC has woken up to RWA’s. Our RSVP list skewed institutional, so we made sure to keep our panel discussion practical: custody, distribution, transfer controls, and real secondary liquidity—less “why blockchain,” more “how do we ship this without breaking compliance.”

How do we judge the space today? (i) Education. Institutions still lack the proper info to make informed decisions on the space. (ii) Transaction volume > TVL. This market has yet to be substantiated, but that’s not to say institutions are not taking bets into the industry. Economic activity will catalyze awareness, which will catalyze economic activity. The flywheel starts with transaction flow. (iii) Community. Collective intelligence and coordination is the unlock to RWA’s. Crypto is ripe with projects solving the same problem twice, unaware that someone in the same room has already made the mistakes and learned the lessons. We’ve seen simple conversations alleviate significant roadblocks.

There’s a lot going on, but we still have a lot to go. While there are a lot of flashy headlines, RWA companies are waiting for the noise to translate to their bottom line. This initial cold start is still apparent in our nascent industry, several institutions are not fully comfortable with RWA’s due to the incomplete value chain. At the core of these financial institutions, there’s massive adoption, but it’s still an underground movement. The ripples of RWA adoption will lapse over years, not months.

Judging by the response post-event, we are excited to deeply integrate with our community and serve as a hub for a slew of services (banking, advisory, cap intro, GTM, legal/compliance, etc). If you’re looking for nearly any support on your RWA initiative, we are confident we can route you in the right direction. Reach out here or below!

Catch ya on the next—

THE RWA DESK